Press Release

Disclaimer: The Press Release section of our news website features articles and announcements submitted by third-party organizations, companies, and individuals. While we aim to publish accurate and up-to-date information, we do not endorse or verify the claims, opinions, or statements made by the authors of the Press Releases. We also do not guarantee the accuracy, completeness, or timeliness of the information presented in the Press Releases.

Readers are encouraged to exercise their own judgment and discretion when reading the Press Releases published on our website. We shall not be liable for any losses, damages, or consequences arising from the use of, or reliance on, the information contained in the Press Releases.

Furthermore, we reserve the right to remove or edit any Press Release that we consider to be inappropriate, inaccurate, or inconsistent with our editorial standards. The views expressed in the Press Releases are solely those of the authors and do not necessarily reflect the views of our news website or its staff.

By accessing and reading the Press Releases on our website, you agree to the terms and conditions set forth in this disclaimer. If you have any questions or concerns, please contact us through our website’s contact form.

-

Kashiv BioSciences and Intas Pharmaceuticals Sign an Exclusive Licensing and Supply Agreement for Complex Peptide Product in Europe, the UK & India

PISCATAWAY, N.J., [February 10, 2026]: Kashiv BioSciences, LLC (“Kashiv”) a vertically integrated biopharmaceutical company, today announced that it has entered into an exclusive licensing and supply agreement with Intas Pharmaceuticals Ltd (“Intas”), a leading multinational pharmaceutical company. The complex peptide product will be commercialized by Intas in India and its subsidiary, Accord Healthcare Ltd (“Accord”), in Europe and the UK.…

Read More » -

The British Drain of Wealth: Why India’s Economic Past Still Shapes Its Present

As India asserts itself as one of the world’s largest economies, its leaders increasingly frame this rise against a long period of economic depletion. Speaking in 2024, External Affairs Minister S. Jaishankar observed that colonialism’s economic impact “is not a closed chapter — it shaped the inequities of the present.” That sentiment reflects a growing global reassessment of empire, extraction…

Read More » -

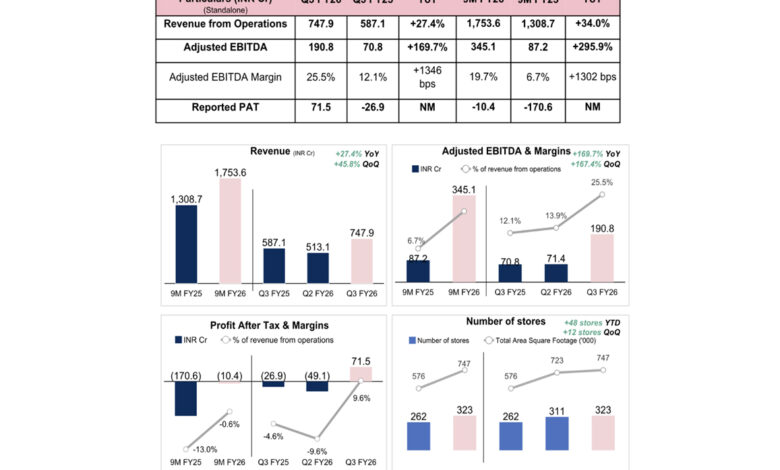

BlueStone reports a milestone quarter by delivering its first positive PAT of INR 71.5 crore

First quarter of positive reported PAT; INR 71.5 crore in Q3FY26 vs. loss of INR 26.9 crore in Q3FY25 Standalone Adjusted EBITDA at INR 190.8 crore, up 169.7% YoY Standalone Revenue at INR 747.9 crore, up 27.4% YoY Cash PAT (standalone) for the quarter at INR 122.5 crore, up 720.9% YoY Jaipur (Rajasthan) [India], January 22, 2026: BlueStone Jewellery and…

Read More » -

U.S.-Based Video Conferencing Platform AONMeetings Announces Plans to Enter Indian Market with Industry-Leading Affordable Pricing

HIPAA-compliant platform with 4.9-star rating to expand internationally, offering Indian businesses, families, and organizations secure video conferencing with integrated webinar capabilities starting at ₹179/month New Delhi, [India], January 19, 2026: AONMeetings, a Des Moines-based video conferencing and webinar platform, today announced plans to launch operations in India, bringing enterprise-grade secure communication tools to Indian small businesses, families, healthcare providers, educational…

Read More » -

YES SECURITIES’ OMNI App Offers Faster, Smarter Demat and Multi-Asset Trading for Today’s Investors

YES SECURITIES designed its OMNI App in line with the leading financial firm’s commitment to digital-first services. The next-generation platform is designed to offer investors a seamless, fast, and smart trading experience. The app features advanced tools, an intuitive interface, and multi-asset capabilities. It enables users to manage equities, derivatives, mutual funds, and bonds from a single platform. With the…

Read More » -

Beacon Trusteeship Appoints Anil Grover as Chief Executive Officer

Mumbai, (Maharashtra) [India], 17 January 2026: Beacon Trusteeship Ltd., India’s first trustee company to be listed on the National Stock Exchange (NSE), announced the appointment of Mr. Anil Grover as its Chief Executive Officer, reinforcing the company’s commitment to strengthening governance-led growth and advancing institutional trust across India’s capital markets. With over three decades of experience across banking, financial services,…

Read More » -

The Biggest Gap in Stock Market Education: How StockSprint Is Bridging Capital, Discipline, and Real-Market Exposure

India’s stock market education landscape is crowded with courses, content creators, and quick-learning promises. Yet, despite unprecedented access to information, a majority of aspiring traders fail to sustain themselves in live markets. The reason is not intelligence or effort. The reason is a fundamental gap in how trading is taught. Most institutes teach what to trade. Very few teach how…

Read More » -

Why Cost Transparency is Becoming Central with Zero Brokerage Accounts

With the rise of zero brokerage trading accounts, cost transparency has become one of the most important factors for investors and traders. Zero brokerage accounts can significantly reduce traditional commission charges, which is helpful for many new users, especially beginners and frequent traders. However, “zero brokerage” doesn’t always mean zero cost. Brokers may still charge regulatory and statutory fees such…

Read More » -

The Shift Towards Transparency as Investors Choose a Zero Brokerage Trading Account

In India, the stock market has provided opportunities for investors to grow their wealth, but for many years, investors had to deal with confusing fees and hidden charges when buying or selling stocks. The traditional brokerage models have relied mainly on these charges, often making trading complex and expensive. These days, a new trend of zero brokerage charges has made…

Read More » -

Put-Call Ratio Gains Importance as Derivatives Participation Grows

Over the past few years, faster growth in derivatives trading has brought a big change in how investors look into market sentiment. As more retail and institutional investors engage in options trading, traditional indicators are being reviewed for how useful they still are. One indicator that now stands out is the put-call ratio (PCR), which has become very important as…

Read More »